Penny Stocks... The Truth Behind Small-Caps

- Admin

- Dec 9, 2024

- 12 min read

Updated: May 8

What Are Penny Stocks?

Everything You Need to Know About These High-Risk, High-Reward Investments

Alright, let’s cut through the noise. You’ve probably heard all sorts of wild stories about penny stocks—turning pocket change into a fortune overnight, scoring those “secret” stocks set to skyrocket.

But here’s the deal: there’s more to small-cap stocks than hype, and if you’re serious about trading, you need the real story.

👋 I’m Will Bell, and with 24 years in the trading trenches, I’ve seen every penny stock myth and miracle out there.

In this post, I’m breaking down the truth behind small-caps: what’s legit, what’s risky, and most importantly, what strategies can actually help you win in this game.

Forget the fluff and the fairy tales.

We’re diving into how penny stocks work, the real opportunities, and the traps to watch out for.

If you’re ready to find out what it really takes to trade small-caps with confidence, you’re in the right place.

So, let’s dig in and get to the truth behind penny stocks.

Why Are Penny Stocks So Alluring to Traders?

Penny stocks have an almost mythical appeal for new investors.

They offer the potential for huge returns with small amounts of money, making them seem like the ticket to quick riches.

But penny stocks are risky, volatile, and often misunderstood.

So, what are penny stocks, exactly?

How do they work, and what should you know before diving in?

In this guide, we’ll cover everything from the basics to advanced strategies and help you understand the full scope of penny stock investing.

1. What Defines a Penny Stock?

A penny stock is generally defined as a share of a small company that trades for less than $5.

They are typically issued by smaller, less established companies and can be found on over-the-counter (OTC) markets like the OTC Bulletin Board or Pink Sheets, as well as on more formal exchanges like the Nasdaq.

Key Characteristics of Penny Stocks

Low Share Price: Often under $5, and sometimes even under $1.

Low Market Capitalization: Penny stocks usually represent companies with smaller market caps.

High Volatility: Prices can swing dramatically in a single day.

Thin Trading Volume: Many penny stocks have fewer trades per day, which can affect liquidity.

2. The History of Penny Stocks and Their Role in the Market

Penny stocks have been around as long as the stock market itself.

Early on, shares of small companies were traded in much the same way they are now.

However, with the rise of online brokerages in the 1990s, trading penny stocks became easier and more accessible to individual investors.

👉 Some famous companies started as penny stocks—Apple, Ford, and Monster Beverage all traded below $5 per share at some point.

Today, the allure of finding the "next big thing" keeps penny stocks popular, despite the risks.

3. How Penny Stocks Are Traded

Penny stocks can be traded on regulated exchanges, but most trade on over-the-counter (OTC) platforms, which lack the strict listing requirements of major exchanges.

Here’s a quick overview of the main trading venues:

OTC Bulletin Board (OTCBB): A regulated electronic trading service where companies must submit financial reports to the SEC.

Pink Sheets: An unregulated marketplace with limited reporting requirements, meaning these stocks can be highly speculative.

Major Exchanges: Some penny stocks trade on major exchanges, but they must meet certain minimum requirements, such as share price and market cap.

Trading penny stocks often requires a broker with access to OTC markets.

It’s important to choose a brokerage that can support these trades, as not all brokers offer them.

4. The Risks of Investing in Penny Stocks

Penny stocks are highly speculative, and it’s essential to understand the risks. Here are some common pitfalls:

a) Lack of Information

Many penny stocks don’t have detailed financial disclosures, making it hard to assess the company’s value. The lack of information can lead to bad investment decisions.

b) High Volatility

Prices can change drastically within minutes. A stock worth $1 could jump to $2—or drop to $0.50—within a single trading day.

c) Liquidity Issues

Low trading volume makes it hard to enter or exit a position without impacting the stock price. You might not be able to sell your shares at the desired price if trading volume is low.

d) Potential for Fraud

Penny stocks are vulnerable to fraud, especially pump-and-dump schemes where promoters artificially inflate a stock's price, encouraging others to buy.

😖 Once the price peaks, they sell off their shares, leaving other investors with significant losses.

Potential Rewards of Penny Stocks

Despite the risks, penny stocks can offer enormous upside potential.

Here are some reasons investors are drawn to them:

a) Low Initial Investment

Because of the low share price, you can buy thousands of shares with a relatively small amount of capital, which can be appealing if you’re looking for high volume.

b) High Growth Potential

Since penny stocks often represent small or emerging companies, there’s the possibility of significant growth if the company succeeds. Some penny stocks experience exponential gains, delivering 100%, 200%, or even 1,000% returns in a short period.

c) The Thrill Factor

For some investors, the excitement of penny stocks is part of the appeal. The potential for massive gains in a single day can be thrilling, though it also comes with considerable risk.

Strategies for Investing in Penny Stocks

While penny stocks are risky, there are strategies that can help manage those risks and improve the odds of success:

a) 👉 Do Extensive Research

Due diligence is vital. Research the company, its management, products, industry trends, and any available financial data. While information can be scarce, even a bit of research can reveal red flags or promising signs.

b) Look for Strong Catalysts

Penny stocks often see the most movement in response to news. Look for upcoming announcements, partnerships, or industry events that could serve as catalysts for the stock price.

c) Use Technical Analysis

Technical indicators can provide valuable insights in penny stock trading. Indicators like moving averages, relative strength index (RSI), and volume analysis can help identify trends and entry or exit points.

d) Set Strict Entry and Exit Points

Define your entry and exit points before making a trade. The volatility of penny stocks means they can turn on a dime, so sticking to your plan is crucial for managing risk.

e) Limit Your Investment

Only invest what you’re willing to lose. Penny stocks are speculative by nature, so never invest money that you can’t afford to lose.

f) Consider the 1% Rule

Similar to risk management in day trading, consider risking only 1% of your account on any single penny stock trade. This approach can help protect your capital from significant losses.

Penny Stock Scams to Watch Out For

The high-risk, low-information environment of penny stocks makes them ripe for scams. Here are some common types to be aware of:

a) Pump and Dump

In a pump-and-dump scheme, fraudsters artificially inflate a stock’s price through misleading statements, promotions, or rumors.

Once the price rises, they sell off their shares, leaving unsuspecting investors with losses.

b) Fake News and Promotions

Some companies or third parties may release false news to boost a stock’s price. Always verify information from multiple sources before acting on it.

c) Shell Companies

Many penny stocks represent shell companies with no real business operations. They exist only to be traded, making them highly speculative.

By staying informed and skeptical, you can protect yourself from these scams and make more informed decisions.

How to Spot a Good Penny Stock Opportunity

👉 Not all penny stocks are destined to fail!

Some present real opportunities, but you need to know how to identify them.

Here are some tips:

a) Look for Financial Stability

A penny stock with solid revenue, assets, and minimal debt is a positive sign. Financial statements can offer insight into the company’s health and potential for growth.

b) Evaluate the Industry

Some industries have higher growth potential. For example, biotech, tech startups, and green energy companies are common penny stock sectors that have seen major growth.

c) Assess Management Quality

The people behind a company matter. Look for experienced, credible management teams with a track record of success.

d) Track Record and History

A stock with a stable price history (even in the penny stock range) is generally safer than one with extreme volatility. This indicates that the company may have a stable investor base and business model.

e) Identify Upcoming Catalysts

If a company has an upcoming product launch, contract announcement, or earnings report, these events can act as positive catalysts for the stock price.

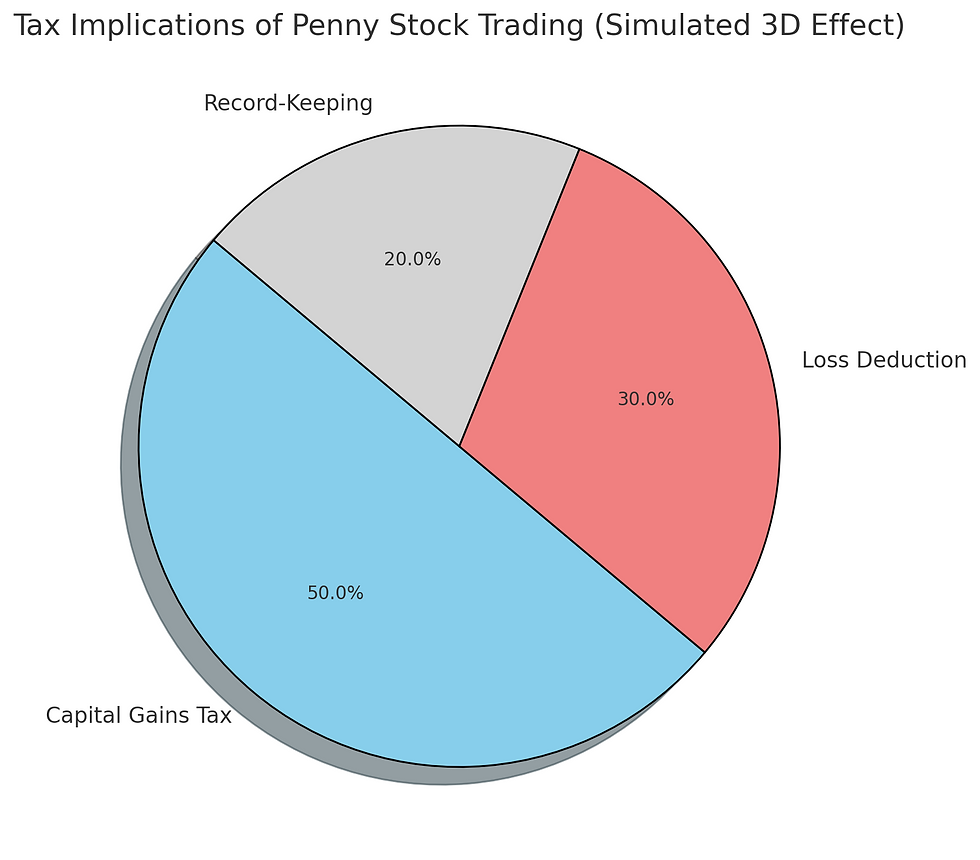

Tax Implications of Penny Stock Trading

Like other investments, penny stock trading is subject to taxes. Here’s what you need to know:

Capital Gains Tax: If you make a profit on a penny stock, you’ll owe capital gains tax. Short-term gains (stocks held less than a year) are taxed at your regular income rate, while long-term gains are typically lower.

Loss Deduction: If you incur a loss, you may be able to use it to offset other gains, reducing your tax bill.

Record-Keeping: Make sure to keep detailed records of all your penny stock transactions, as they can be subject to audits.

Consulting a tax professional is wise, especially if you’re frequently trading penny stocks.

Tools and Resources for Penny Stock Investors

Investing in penny stocks requires access to reliable tools and resources.

Here are some that can make your trading journey easier:

a) Stock Screeners

Screeners allow you to filter stocks based on criteria like price, volume, and industry, making it easier to find penny stocks with potential.

b) Trading Platforms

Choosing a platform that supports penny stock trading is essential. Some popular brokers for penny stocks include E*TRADE, TD Ameritrade, and Fidelity.

c) News Feeds and Alerts

Staying on top of news is critical. Services like Benzinga, Google Alerts, and Seeking Alpha provide timely updates that can impact stock prices.

d) Technical Analysis Tools

Technical analysis is particularly useful for penny stocks, which often experience sharp price movements. Platforms like TradingView and Thinkorswim offer comprehensive charting and technical indicators to help you analyze trends and make informed decisions.

e) Research Reports and Financial Filings

For penny stocks that file reports, the Securities and Exchange Commission (SEC) database (EDGAR) is a valuable resource. You can access annual and quarterly reports, as well as other filings that provide insight into a company’s financial condition.

f) Social Media and Forums

While you should be cautious of hype, social media platforms and trading forums can offer insights and community support. Platforms like Reddit’s r/pennystocks and StockTwits can provide valuable perspectives, although it’s essential to verify any information you find.

Using a combination of these tools can help you build a stronger foundation for making penny stock investments and help you navigate the unpredictable world of penny stocks.

Developing a Penny Stock Trading Strategy

Trading penny stocks without a strategy is a recipe for losses.

Here’s a structured approach to building a strategy that works for you:

a) Set Clear Goals

Identify what you want to achieve with penny stock trading. Are you looking for quick profits, or are you willing to hold positions for potential long-term growth?

Your goals will shape your approach and trading style.

b) Choose a Style of Trading

Penny stocks lend themselves to a variety of trading styles. Here are some popular ones:

Scalping: Focus on small, quick trades to capture rapid price movements.

Momentum Trading: Buy stocks that are trending upward in hopes of further gains.

Swing Trading: Hold stocks for a few days or weeks to take advantage of short-term trends.

c) Use Entry and Exit Triggers

Set specific criteria for when to buy and sell.

For example, you might decide to enter a trade when a stock breaks above its moving average or hits a new 52-week high.

Similarly, establish exit points to lock in profits or limit losses.

d) Establish Risk Management Rules

Penny stocks are volatile, so it’s critical to set stop-loss orders to limit losses.

Additionally, using position sizing to determine how much capital to risk per trade can help you protect your account from large swings.

e) Backtest and Refine Your Strategy

If possible, test your strategy with historical data to see how it would have performed in different market conditions.

Many trading platforms offer backtesting tools, allowing you to refine your strategy before risking real money.

Having a well-defined strategy gives you a framework for decision-making and helps you avoid emotional reactions, which are common in the high-stakes world of penny stocks.

Case Studies of Successful (and Failed) Penny Stock Investments

Sometimes, the best way to learn about penny stocks is by examining real-life examples. Here are a few case studies that illustrate both the rewards and risks:

a) True Success Story: Monster Beverage

Monster Beverage (formerly Hansen Natural) is one of the most famous penny stock success stories. The company’s shares traded for under $1 in the 1990s before exploding in value as the energy drink market took off.

Monster’s growth transformed it into a billion-dollar company, and its stock became one of the best performers of its time

b) High-Risk Failure: Kmart Corporation

Kmart, once a giant retailer, fell to penny stock levels after filing for bankruptcy. Despite temporary surges from restructuring announcements, Kmart eventually failed to recover.

The lesson here is that just because a company was once prominent doesn’t mean it can bounce back from financial trouble.

c) A Classic Pump-and-Dump: Biozoom

Biozoom gained infamy in 2013 when it was touted by promoters, leading to a massive increase in its share price.

Unfortunately, the price crashed after the promoters dumped their shares, leaving investors with huge losses. This example illustrates the risks of pump-and-dump schemes in the penny stock market.

Learning from these case studies can provide valuable insights into what to look for—and avoid—when trading penny stocks.

Penny Stocks and the Psychology of Investing

Penny stocks can be thrilling, but they also have a psychological impact. The fast-paced and high-risk nature of penny stock trading can lead to emotional decision-making.

Here’s how to manage the psychology of investing in these stocks:

a) Overcoming Fear and Greed

The volatility of penny stocks can create emotional highs and lows.

Fear of missing out (FOMO) can lead to impulsive buys, while greed can prevent you from selling at the right time.

Develop discipline by setting entry and exit points in advance and sticking to them.

b) Learning from Losses

Losses are part of the learning curve in penny stock investing. Instead of letting them discourage you, analyze what went wrong.

Did you skip due diligence?

Was your timing off?

Viewing losses as lessons helps you improve your strategy.

c) Staying Disciplined

With penny stocks, discipline is everything.

Avoid falling for hype, and always rely on research and data-driven decisions.

Keep a trading journal to track your trades, review past mistakes, and refine your approach.

Understanding and managing the psychological factors involved in penny stock trading can increase your chances of making sound decisions and reduce the impact of emotions on your trades.

Avoiding Common Penny Stock Mistakes

🥵 When trading penny stocks, even experienced traders can fall into traps.

Here are some common mistakes to avoid:

a) Skipping Research

Without solid research, you’re essentially gambling. Always investigate the company’s financials, news, and industry trends.

b) Investing Too Much Capital

Never put all your money into penny stocks. The high risk means you should only allocate a small portion of your portfolio to these investments.

c) Ignoring Exit Strategies

Penny stocks can change rapidly, so it’s essential to have a clear exit plan. Not having a plan can lead to holding onto losses or missing opportunities to take profits.

d) Trusting “Hot Tips” or Promotions

Penny stock promotions are often misleading. Instead of following tips from unknown sources, rely on your own research and analysis.

e) Revenge Trading

It’s easy to try and “win back” losses by doubling down on a bad trade. But revenge trading often leads to more significant losses. Stick to your strategy and avoid emotional reactions.

Being mindful of these common pitfalls can help you make more informed decisions and avoid unnecessary losses.

Should You Invest in Penny Stocks? Final Thoughts

Penny stocks aren’t for everyone.

They carry high risks, require in-depth research, and demand a disciplined approach.

For those willing to put in the effort and manage risk, penny stocks can offer substantial rewards.

Here’s a quick recap to help you decide if they’re right for you:

Pros:

Low Capital Requirement: You can start with a small investment.

High Reward Potential: Penny stocks offer the possibility of outsized gains.

Opportunity to Get in Early: Some penny stocks represent emerging companies with growth potential.

Cons:

High Risk and Volatility: Penny stocks can lead to significant losses.

Lack of Information: Many penny stocks have limited transparency.

Potential for Scams: The penny stock market has a history of fraud and manipulation.

If you’re interested in penny stocks, start small, do your research, and be prepared for a rollercoaster ride.

Penny stocks can be an exciting part of an investment portfolio, but they require a cautious and well-informed approach.

Additional Resources for Penny Stock Investors

Whether you’re just starting or looking to refine your strategy, there are plenty of resources to help you on your penny stock journey:

a) Books

“Click Here for My Free Book The Legendary Rules For Trading Penny Stocks – A great introduction to the world of penny stocks.

b) Online Courses

Golden Penny Stock Millionaires offers courses specific to penny stocks and small-cap investing.

c) Financial News Websites

Sites like Yahoo Finance, MarketWatch, and Benzinga provide news and stock analysis that can be helpful for penny stock investors.

d) Penny Stock Newsletters and Reports

GPSM Stock Alerts investment platforms offer's premium newsletters focused on penny stocks.

e) Trading Simulators

Practicing with a trading simulator or demo account can help you develop skills without risking real money.

Conclusion: The Path Forward in Penny Stock Investing

Penny stocks can offer both thrill and profit potential, but they come with unique risks that require careful consideration.

If you’re thinking about entering the world of penny stocks, take the time to educate yourself, start with a small investment, and develop a disciplined approach.

In the end, penny stocks are a high-stakes, high-reward investment, and the potential for success depends on your ability to stay informed, manage risk, and avoid common pitfalls. With the right mindset and strategy, you can navigate the volatile world of penny stocks and take advantage of the opportunities they present.

This wraps up our in-depth guide on penny stocks!

👉 Remember, investing always carries risks, and penny stocks are no exception. By staying disciplined and informed, you’ll be better prepared to handle the ups and downs of this unique investment world.

Alright, so now you know the truth behind penny stocks—the real risks, the hidden opportunities, and what it takes to navigate this wild corner of the market.

But here’s the thing: knowing is only half the battle.

Taking action is where the real magic happens.

If you’re ready to move beyond theory and start making smarter moves with penny stocks, here’s your next step. Join me with Golden Penny Stock Millionaires and get direct access to real-time alerts, expert insights, and proven strategies to help you capitalize on these high-growth opportunities.

Don’t just read about it—start trading like a pro.

Sign up now today and get in the game with the confidence and guidance you need.

Let’s turn this knowledge into action, and take your penny stock trading to the next level!

Comments